A lot of people like to stay within the comfort zone when it comes to buying something. The same is the case with loans and financing services. However, what they often forget is that technology has now made everything way more convenient and flexible.

If you have been planning to borrow a personal loan soon, then try using finance apps for the same. With the help of loan apps in India, you will be able to get the best possible borrowing experience ever. Moreover, these applications can also give you many benefits.

In case if you would like to know more about why you should apply for a loan online using a finance app, then read the following points.

1. Quick approval:

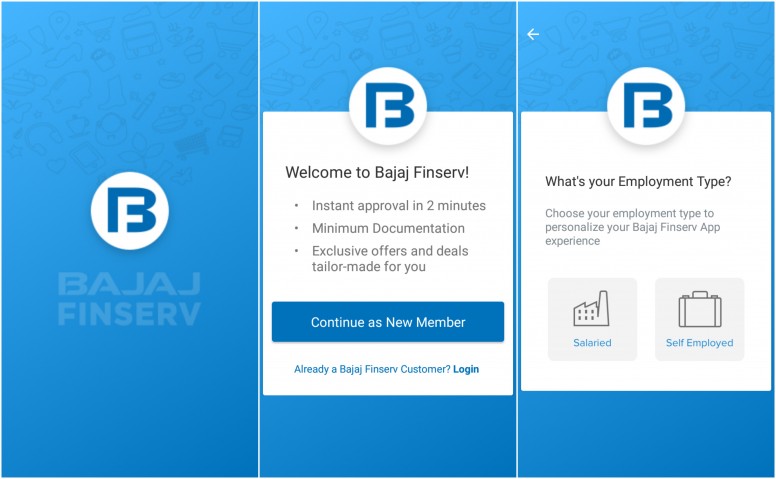

When you apply for a personal loan online, the first thing that you get is instant approval. The facility is specifically available on the Bajaj Finserv app, making it easy for borrowers across the country. In other words, no matter where you are sitting and what time you are applying for a loan, you can enjoy instant loan facility always via an online loan app. On the other hand, online platforms like finance apps have all the relevant details about credit services available.

2. Online documentation:

Usually, when it comes to submitting documents for a financing service, you would have to carry copies as well as original certificates to the lender itself. You would then need to get them verified and begin with the rest of the process. However, when it comes to applying for loans online using finance apps, for example, you do not need to go through the entire hassle. You can simply scan the documents and attach them online with your loan application. Some online lenders may also let you submit those documents at your doorstep to executives who come to collect them.

3. Exclusive feature:

The next reason why we recommend you should apply for a loan online is because of the exclusive features. Depending on the lender you choose for your financing needs, you can get a number of different features and offers. For example, in some finance apps, you can also see a family sharing option. It allows your family members to operate the account and view vital information.

4. Curated offers:

A unique feature that can be seen in online loan application methods is curated offers. Even though numerous deals are active every single day, certain financing agencies provide you with specially designed offers. These offers are specific to your needs as well as financing type. Therefore, applying for a loan online using finance apps can be a great idea to make the most of the opportunity.

5. One platform multiple options:

Even though you will be using only one platform to apply for your loan online, you will still be able to enjoy various facilities. Whether it is about making payments online or getting regular notifications about updates, it can all be done using finance apps. It means you will not have to keep track of multiple things to know the status of your account.

Bajaj Finserv App gives borrowers financing alternatives like a business loan, personal loan, credit card, and more. Apart from this, you can even find a number of pre-approved offers for these financing services. By utilizing the given offers, you will be able to cut down the loan processing time and make it less time-consuming.