Mobile phones have grown to become an extension to our brain’s functions. They are essential to numerous aspects of our lives, and are increasingly encroaching into new territory. These devices are the ultimate personal assistants, so it makes sense if they are also taking charge of your personal finances.

A number of mobile payment programs and trends have emerged in recent years. Every day, more people are looking to become a part of this new technology. If you are one of these people aspiring to digitize your finances, then here is a complete guide to your options: the ten mobile payment trends that you should be aware of.

Mobile Wallets

If you wish to go mobile with your payments, then it is vital that you download a mobile wallet onto your phone. They are precondition to any mobile payment method. These apps are making their way into millions of phones, as demonstrated by the fact that in China, two-thirds of all purchases in 2016 where made via these digital wallets.

Increased Penetration

Generation Z is the demographic born during and after the financial crisis, and advertisers are scrambling to rear them in. They are expected to become 40% of all US consumers by 2021, and research is showing that they are going to be avid users of mobile payment services. It makes sense, as these services allow us to conveniently pay with nothing more than our smartphones. As this research demonstrates, their use is only going to grow due to demographic trends.

Demand for Speed

Once upon a time, people were perfectly comfortable with waiting in long queues until their purchases can be processed. When it came to online shopping, then it would take at least a few days to deliver. But today, consumers want their products in their hands as quickly as possible.

This makes sense in lieu of the fact that our modern globalized economy and technology dependent lifestyles are extremely fast-paced. Every second counts, and none of us can afford to spend time entering PIN codes and waiting for transactions to process. Mobile payments make this whole affair lightning fast, so it makes sense why they are becoming so popular.

Prevalence of Mobile Assistants

We mentioned above how cellphones are kind of like personal assistants today. This is true in many respects, as most smartphones now have dedicated personal assistants that help you with your daily affairs. These programs have extensive knowledge about our buying habits. As a result, not only do they process purchases for us but also inform us on when items we like are going on sale.

This is demonstrative of how mobile payments are tying into existing smartphone infrastructure, which shows how widespread their use really will be in the future.

Swift Payment

What initially started in the food industry, and then the entertainment industry is quickly spreading into other spheres on the economy. Swift payment methods have become popular by virtue of the fact that people do not want to spend too much time doing mundane things. As a result, it is only a matter of time until mega corporations start accepting payments via these technologies.

Contactless Payment

The primary motivations behind any new innovation are convenience and time-efficiency. Contactless payment is a godsend from the point of view of consumers.

Simply download a mobile wallet app, like Apply Pay or Android Pay, and enter your credit or debit card’s details into it. The next time you are in a shop that accepts payment through mobile wallets, simply connect to the POS terminal’s high frequency radio wave. It will connect to the smart chip ingrained in your card securely, so you can be confident that there will be no breaches of security.

After that, all you need to do is approve the transaction.

Near-Field Communication Payments

Near-Field Communication Payments (NFC) works essentially the same as contactless. The primary difference is the operations of the technology.

In this case, the reader generates an RF field that your phone will pick up. All you need to ensure is that your phone has a compatible mobile wallet installed on it for this purpose. NFC is excellent for the US market due to the adoption of EMV security standards that make it safer to use.

Bluetooth Payments

While many of you might dismiss Bluetooth technology at the mere mention of it, it is undeniable that it has certain advantages that the former two simply do not.

NFC is great, but it is still in its infancy. It requires the phone and reader to be in close proximity in order to work. Bluetooth on the other hand, has a much wider range, and that has real practical advantages. You might not even have to take you phone out altogether because of this, which automatically speeds up the payment process.

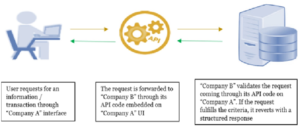

Application Programming Interfaces (APIs)

If we had to describe APIs in novice terms; they are basically a method of communication between the various components and features that comprise a software. It is this ability to communicate that is capturing headlines.

Europe is the forerunner in this technology, as it has recently passed a Payment Services Directive. Under it, account information service providers can access customer information using API, as can third person payment service providers make transactions via them. All this is expected to be an immense boost to the financial industry by increasing competition among its numerous players.

Bank Assured Payments

Consumers today, and especially the consumers of tomorrow, Generation Z, are showing an increased tendency of using multiple cards and switching between multiple service providers if they feel like it is more advantageous.

This has incentivized banks to change the way they operate as their current structures allow for very little room for improvements. After they have come to learn about what the future holds, they have been spurred into action as they try to adjust for it. Consumers are only just beginning to see examples of these changes.

These are some of the many ways consumers will see mobile payment platforms progress as a technology in 2018. By understanding these basics, you will know why you will know not only why it is imperative that you become a part of this experience as soon as possible, but what you can look forward to once you do.